In today’s world, everyone is aware of the significance of robust security, given the rising incidences of fraudulent activities. One measure financial institutions and businesses implement is KYC or Know Your Customer. This system helps to maintain and strengthen the security systems of crucial organizations such as banks.

When a customer opens a bank account, KYC is done by submitting documents like government-issued identification, name, proof of date of birth, address, etc. This way, the organizations can seamlessly maintain their relationship with the customer after authenticating their identity.

You may learn more about what KYC is and its numerous benefits below.

What Is KYC or Know Your Customer?

Know Your Customer, or KYC, is a crucial process that aids in confirming a customer’s identification. The relevant authority gathers and validates personal data to ensure that clients are truly who they say they are.

It contains the client’s name, birthdate, address, and government-issued identity document. Then, to address and reduce risks related to identity theft, money laundering, and fraud that may impact both the consumer and the business, this information is validated using various techniques.

Benefits of KYC Verification

The following are the benefits of KYC verification:

1. Prevention of Money Laundering and Financial Crime

Preventing the funding of terrorists and countering unlawful financial activity are among the most significant advantages of KYC verification. Additionally, there is always a chance that money laundering will occur when banks and financial organizations are uninformed of who has an account with them, how the money is being handled, or where it is coming from or going.

In this context, KYC verification is crucial. It divulges all of these facts that aid law enforcement in understanding offenders.

Criminal organizations sometimes utilize money laundering to conceal the earnings of their illicit activities, including those related to drugs, human trafficking, cybercrime, and other crimes. By accurately identifying consumers or keeping an eye out for dubious activity, a thorough KYC verification aids in the prevention of money laundering from the very beginning.

2. ID Fraud & Risk Mitigation

The issue of fraud is getting worse for financial institutions (FIs) worldwide. According to PwC, over 46% of businesses have experienced some kind of fraud. A corporation is significantly more likely to have experienced attempted fraud if it generates more than USD 10 billion in annual revenue.

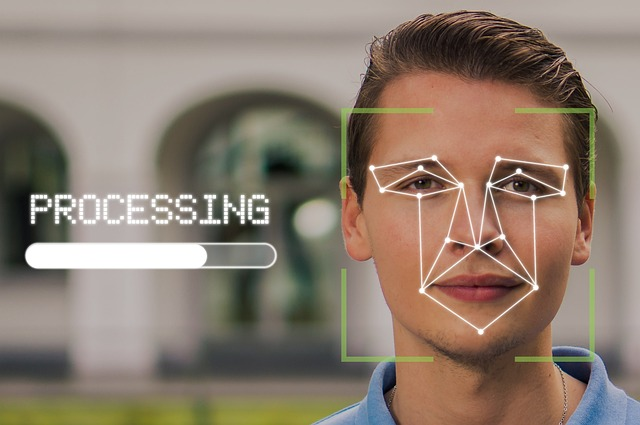

The first line of defense for FIs against fraud and cybercrime is KYC verification. Customer Identity Verification (CIP) in KYC uses robust techniques like matching faces and intelligent profile checks enabled by machine learning to ensure that customers are indeed who they say they are.

Programs for Customer Due Diligence (CDD) are also essential for lowering risks. Consumers receive risk scores from them, which enables FIs to monitor their behavior continuously.

3. Data Management & Auditing

Financial institutions (FIs) routinely collect erroneous and disorganized data when they recruit new clients. As a consequence, financial institutions find it difficult to create proper client profiles to manage risks and tasks. KYC verification also lays out the rules for data maintenance and collection, making it easier for Fis to obtain and manage the client data efficiently.

In addition, it established certain protocols for acquiring customers, streamlining the onboarding process, boosting audit procedures, helping financial institutions comply with the law, etc.

4. Compliance and Enhance Security

KYC verification is regarded as one of the key components of improving security and compliance. During the process of identification and authentication of the customers, a business must implement KYC to maintain compliance with the regulations and laws. This process will help ensure that firms take the necessary action to end illicit activities like money laundering, fraud, terrorist funding, and identity theft.

Additionally, KYC helps enhance security to ensure the customer’s data is accurate and current. This serves as a security precaution to safeguard client information and deter unauthorized individuals from interfering with the business’s systems.

5. Improved Customer Experience and Operational Efficiency

In recent times, KYC or know your customer services are, undoubtedly, a blessing for several businesses. It aids in attracting new customers quickly and easily by offering a seamless experience and emphasizing their satisfaction.

Automating and verifying client ID enables companies to comply with the laws efficiently. Again, this enhances the overall effectiveness as they own more resources for other business purposes.

6. Global Expansion

Businesses use the KYC system to boost their presence internationally, aiming to take the first step towards global expansion. KYC will help to maintain compliance with the legislation in different countries. It will enable companies to offer their services globally. Businesses can efficiently initiate communication in various regulatory circumstances.

Furthermore, this worldwide reach will allow them to interact with a large client basis by building themselves as a credible organization. Businesses may reach new markets and improve their prospects of growth and success by following international norms.

Conclusion

KYC is among the most essential and mandatory procedures that all businesses and financial institutions must implement in their system. Given the benefits of KYC verification mentioned above, you can ensure complete regulatory compliance, enhanced security, and customer trust.

Furthermore, KYC has proved to be beneficial in safeguarding you from illegal and fraudulent activities. With it becoming a crucial tool, maintaining financial systems in this digital environment is now easier.